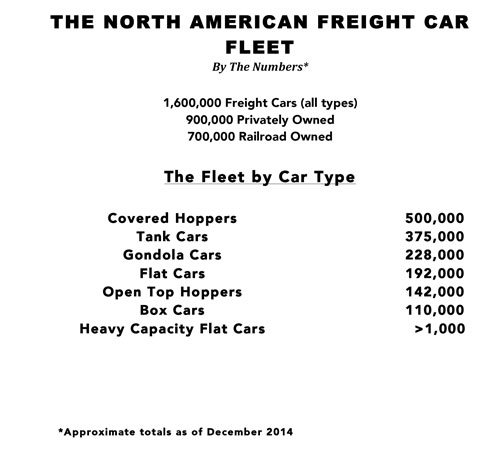

The ongoing worldwide reset in commodity prices has most freight car values in a state of flux. Coal, once the single most important commodity to rail freight by annual tonnage, has undergone a rapid transformation while other rail served industries and commodities are certain to face structural and market challenges in the years ahead.

What the future holds for freight car values in general and freight car values dependent on coal, oil, agriculture, steel and chemicals in particular has profound implications for all freight car owners, lessors and investors.

Railroad Technology Corporation (“RTC”) provides timely and accurate freight car appraisals including current resale values, residual value forecasts and lease portfolio valuations for all types of freight equipment.

The RTC management team brings over 100 years of collective railroad industry fleet management, capital equipment lease finance and asset disposition expertise to all freight car appraisal and valuation assignments.

RTC routinely employs four (4) integrated methods to calculate freight car values:

- The Market Approach – Recent sales of comparable equipment.

- The Income Approach – Net Present Value of lease rent plus future residual value.

- The Replacement Cost Approach – The AAR (“Association of American Railroads”) method using both annual depreciation schedules and replacement cost built date factors.

- The Blended Income and Replacement Cost Approach.

To learn more about RTC Appraisals & Valuations, please complete Registration & Preferences or telephone Bob Ness @ (415) 515-2110.

English

English Español

Español Français

Français